fsa health care limit 2022

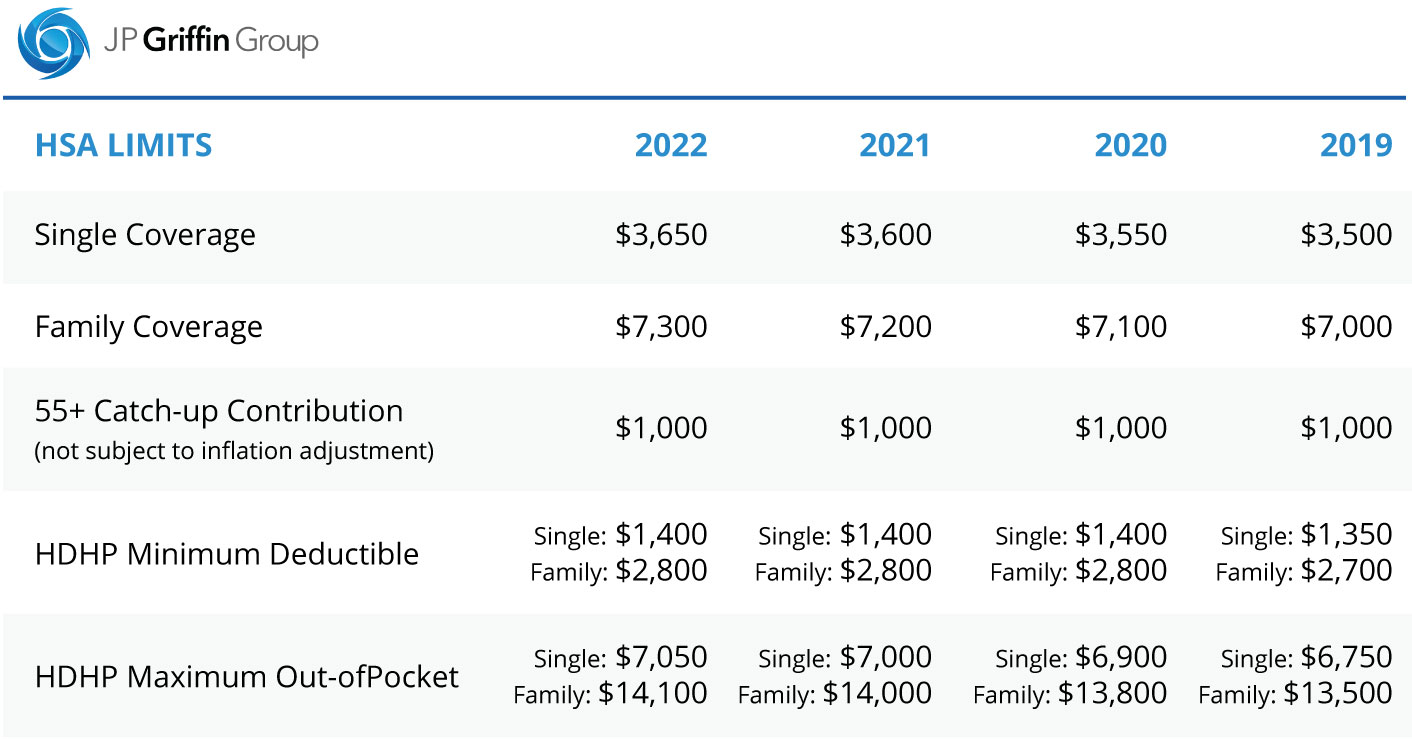

Employers should communicate their 2022 limit to their employees as part of the open enrollment process. The limit on annual employee contributions toward health FSAs for 2022 is 2850 up from 2750 in 2021 with.

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

And the limit on total employer-plus-employee contributions to defined contribution plans will jump to 61000 in 2022 which is.

. The limit is expected to go back to 5000. For 2022 the dependent-care FSA limit returns to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately. Dependent Care FSAs which previously allowed no carryover also have an unlimited carryover provision in 2021-2022.

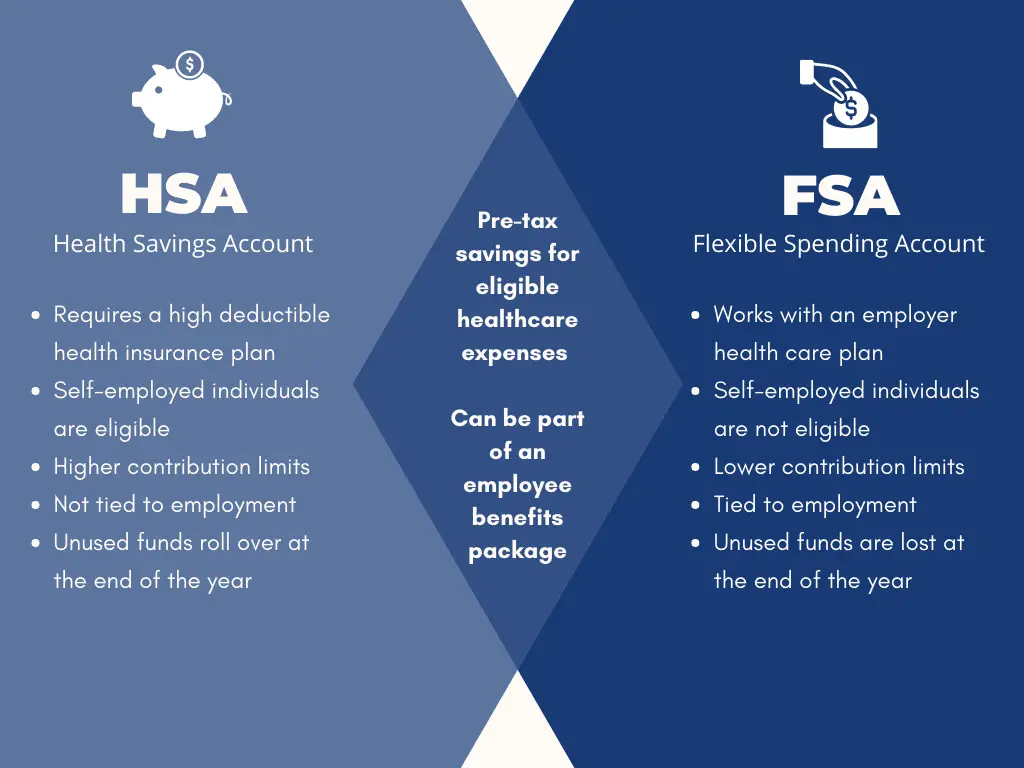

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021. Employees can elect up to the IRS limit and still receive the employer contribution in addition. As with a Health Care FSA HCFSA the maximum annual allotment for a LEX HCFSA is 2850 per covered employee or 5500 for a feder.

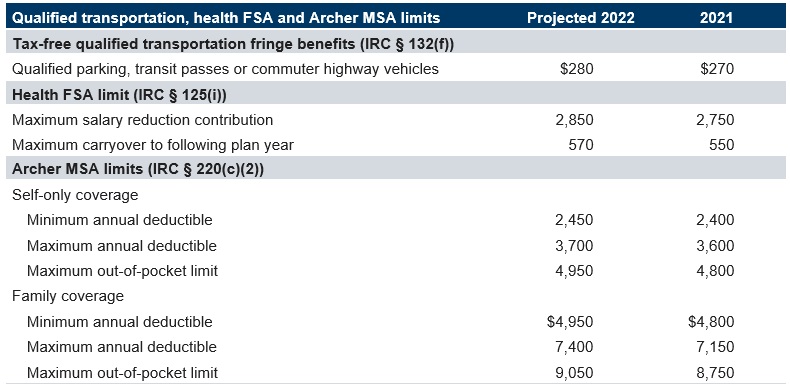

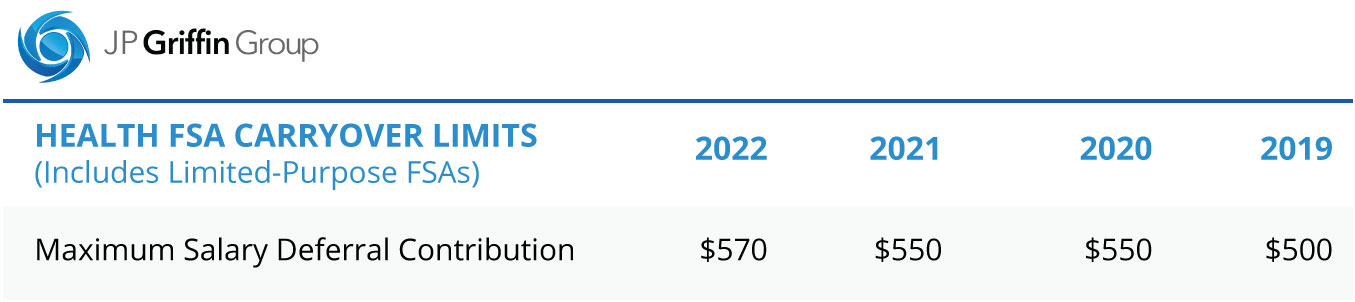

For 2022 the maximum amount that can be contributed to a dependent care account is 5000. Qualified Parking plans 280 month. Health FSA maximum carryover of unused amounts 570year.

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. Health FSA including a Limited Purpose Health FSA 2 850 year. 3 rows Employees can put an extra 100 into their health care flexible spending accounts health.

Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses. With a LEX HCFSA you can set aside anywhere from a minimum of 100 up to 2850 per benefit period plan year. Expanded FSA Grace Period.

For the 2021 income year it is 2750 26 USC. The 2022 limits for. The Dependent Care FSA annual maximum plan contribution limit is 2500 for those married and filing separately and 5000 for those single or married filing jointly.

The health FSA contribution limit is established annually and adjusted for inflation. Qualified Transportation plans 280month. If you have a dependent care FSA pay special attention to the limit change.

Double check your employers policies. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022. The health FSA dollar.

If you provide health care FSA employer contributions this amount is in addition to the amount that employees can elect. Health FSA Carryover Maximum. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022.

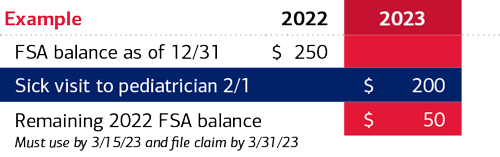

How much can I contribute to my LEX HCFSA. 2022 FSA carryover limits. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year.

The minimum annual election for each FSA remains unchanged at 100. However the Act allows unlimited funds to be carried over from plan year 2021 to 2022. The amount of money employees could carry over to the next calendar year was limited to 550.

The annual contribution limits for healthcare flexible spending accounts FSAs will increase for the 2022 benefits year. Dependent Care Assistance Plans Dependent Care FSA annual maximum if married filing separately. It is important to note that the carryover from the 2022 plan year will once again be limited to 570 or an inflation-adjusted amount.

Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC. You can use your Dependent Care FSA. The Health Care standard or limited FSA rollover maximum limit will increase from 550 to 570 for plan years beginning on or after January 1 2022.

Health and dependent care flexible spending accounts FSAs are employer-sponsored benefit. Healthcare Flexible Spending Account FSA 2850. Excepted Benefit HRA remains 1800year.

Employers may continue to impose their own dollar limit on employee salary reduction contributions to health FSAs up to the ACAs maximum. And if an employers plan allows for carrying over unused health care FSA funds the maximum carryover amount has also risen up. Dependent Care Assistance Plans Dependent Care FSA annual maximum unless married filing separately.

If you have the FSA Grace Period extension built into your plan and your plan year ends on December 31 you probably have a deadline coming up on March 15. If you have adopted a 570 rollover for the health care FSA in 2022 any amount that rolls over into the 2023 plan year does not affect the maximum limit that. FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum for a combined household set aside of 5700.

Learn more from GoodRx about the increase in FSA contribution limits and how to. The IRS announced that the health FSA dollar limit will increase to 2850 for 2022. The contribution limit is 2850 up from 2750 in 2021.

Among other things the notice indicates that employee contribution limits toward health flexible spending arrangements also known as flexible spending accounts or FSAs and qualified transportation fringe benefits will increase slightly for 2022. The 2022 medical FSA contribution limit will be 2850 which is up 100 from last year. Health Care FSA Limits Increase for 2022 Employees can deposit an incremental 100 into their health care FSAs in 2022.

Qualified Small Employer HRA QSEHRA increases to 5450year for single. Effective January 1 2022 the following will be the new limits. 125i IRS Revenue Procedure 2020-45.

Irs Releases 2022 Rates For Healthcare Fsa And Commuter Benefits Sequoia

2022 Fsa Limit Lawley Insurance

Irs Adjusts Health Fsa And Other Limits For 2022 Woodruff Sawyer

Flexible Spending Account Contribution Limits For 2022 Goodrx

Best Health Insurance Companies 2022 Top Ten Reviews

Flexible Spending Account Contribution Limits For 2022 Goodrx

Flexible Spending Account Contribution Limits For 2022 Goodrx

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

Understanding The Year End Spending Rules For Your Health Account

Flexible Spending Account Contribution Limits For 2022 Goodrx

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Hdhp Vs Ppo What S The Difference

New Hsa Limits For 2022 And Determine If Fsa Or Hsa Is Right For You Alltrust Insurance